Online conversations about a possible $2,000 direct deposit in February 2026 have gained a lot of attention. Social media posts and financial forums are filled with claims suggesting that a large federal payment could soon reach millions of bank accounts. While these discussions are spreading quickly, it is important to separate official facts from speculation. At this time, there is no confirmed federal stimulus program that guarantees a universal $2,000 payment for everyone.

In many cases, the $2,000 figure being discussed is connected to regular tax refunds rather than a newly approved government deposit. During tax season, many households receive refunds close to this amount. This usually happens when taxpayers have had more federal tax withheld from their paychecks than they actually owed, or when they qualify for certain refundable credits. Credits such as the Child Tax Credit or the Earned Income Tax Credit can significantly increase the final refund amount.

For example, a family with moderate income and eligible dependents may see a refund near $2,000 once credits are applied. This does not mean a new program has been launched. It simply reflects how tax calculations work when credits and overpayments are included.

यह भी पढ़े:

Federal $2,000 Payment February 2026 Alert: Eligibility Rules, Payment Timeline, and Official Status

Federal $2,000 Payment February 2026 Alert: Eligibility Rules, Payment Timeline, and Official Status

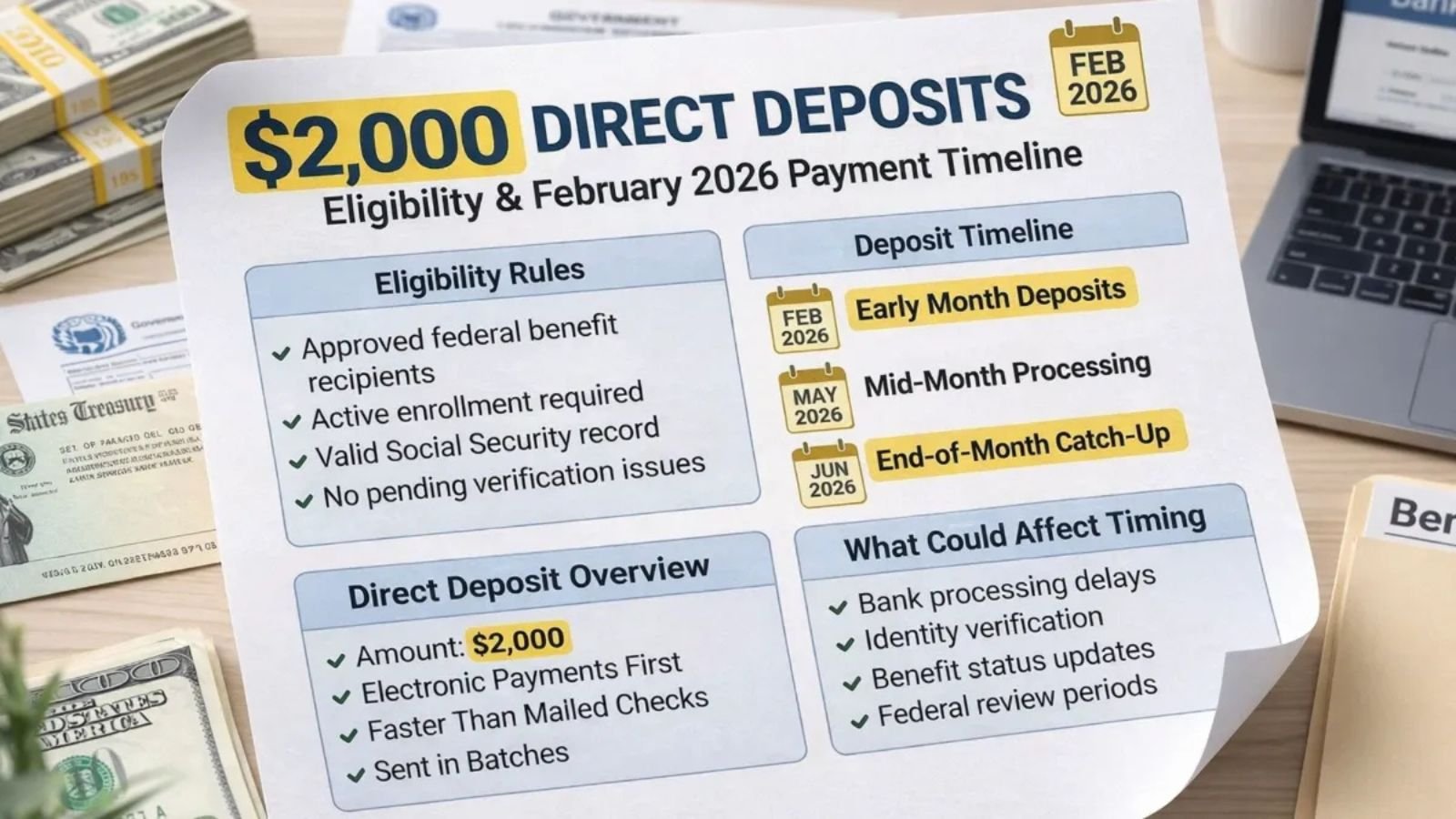

The timing of any refund depends on IRS processing rules. Electronic returns are usually processed faster than paper filings. In many cases, electronic filers who choose direct deposit receive their refunds within about 21 days after their return is accepted. However, errors, missing information, or identity verification checks can delay payment. Paper returns and amended returns often take several additional weeks.

Eligibility for a refund around $2,000 varies by individual. Income level, filing status, tax credits claimed, and total withholding during the year all influence the final amount. There is no standard refund that applies to everyone. Taxpayers should review their personal tax details instead of assuming a fixed payment based on online trends.

It is also important to stay alert for scams. Fraudsters may claim that personal information is required to release a $2,000 deposit. The IRS does not request sensitive details through unsolicited messages. Official IRS tools and secure online accounts are the safest ways to check refund status.

यह भी पढ़े:

$2,000 Direct Deposit February 2026 Explained: Eligibility Criteria, Payment Timing, and Updates

$2,000 Direct Deposit February 2026 Explained: Eligibility Criteria, Payment Timing, and Updates

In summary, there is no confirmed nationwide $2,000 direct deposit scheduled for February 2026. Some taxpayers may receive refunds near that amount based on their individual tax situation. Understanding how refunds work helps avoid confusion and unrealistic expectations.

Disclaimer: This article is for informational purposes only and does not provide tax, financial, or legal advice. Refund amounts, eligibility, and timelines depend on individual circumstances and IRS procedures. Readers should consult official IRS resources or a qualified tax professional for accurate guidance.