Tax season 2026 is moving quickly, and many Americans are closely watching their bank accounts for their IRS refunds. With updated processing systems and ongoing fraud prevention checks, knowing when your refund may arrive can help you plan your finances more confidently. If you have already filed your return or are preparing to do so, understanding the general refund timeline is essential.

The IRS usually starts accepting federal tax returns in late January. Once your return is electronically submitted and officially accepted, processing begins. For most taxpayers who file online and choose direct deposit, refunds are often issued within about 21 days. However, this is an estimate, not a guarantee. The exact timing depends on the accuracy of your return and whether any additional verification is required.

Filing method plays a major role in refund speed. Electronic filing is much faster than mailing a paper return. Paper filings require manual review, which can significantly extend processing time. Choosing direct deposit instead of a mailed check also reduces waiting time, as electronic transfers move more quickly through the banking system.

Based on common IRS processing patterns, taxpayers who file in late January may see refunds by mid or late February. Those filing in early February may receive payments by late February or early March. Returns submitted in March are generally processed within three weeks of acceptance, assuming there are no issues.

Several factors can delay a refund. Claiming refundable tax credits such as the Earned Income Tax Credit or Child Tax Credit may trigger additional review. Errors in personal details, incorrect bank account numbers, or identity verification checks can also slow down approval. Amended returns typically take longer than original filings.

Taxpayers can monitor refund progress through the official IRS tracking tool. Status updates are usually available within 24 hours for electronic returns. The system shows three main stages: return received, refund approved, and refund sent. If there is no change after three weeks, further review may be underway.

यह भी पढ़े:

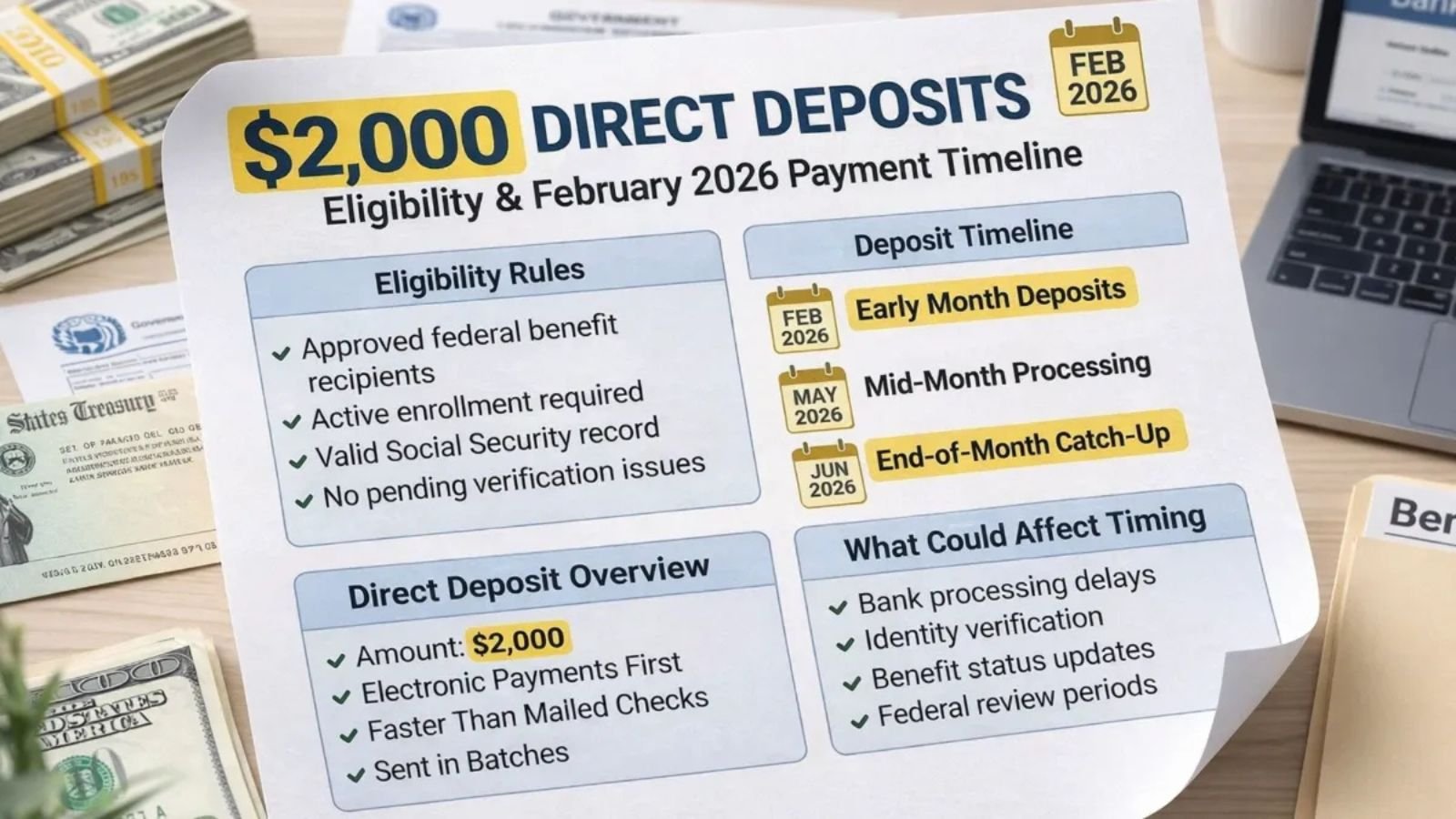

Federal $2,000 Payment February 2026 Alert: Eligibility Rules, Payment Timeline, and Official Status

Federal $2,000 Payment February 2026 Alert: Eligibility Rules, Payment Timeline, and Official Status

Filing early, double-checking information, and responding promptly to IRS notices can help prevent delays. While many refunds arrive within the expected timeframe, planning for possible minor delays can reduce stress during tax season.

Disclaimer: This article is for informational purposes only and does not provide tax, financial, or legal advice. Refund timelines and amounts vary based on individual circumstances and official IRS procedures. For accurate updates and personalized guidance, consult the Internal Revenue Service or a qualified tax professional.